Blogs

The fresh Irs’s commitment to LEP taxpayers falls under an excellent multiple-season timeline you to began bringing translations inside 2023. You will consistently found correspondence, and observes and you will emails, in the English up to he or she is translated for the popular words. Anyone can publish solutions to all or any sees and characters playing with the fresh Document Upload Device. To own notices which need a lot more step, taxpayers might possibly be redirected appropriately to the Internal revenue service.gov for taking then action. If you have questions relating to an income tax topic; need help planning the income tax come back; or should free download books, models, or tips, go to Internal revenue service.gov to find information that can help you right away.

Staff Prohibited Ashore Once GI Episode Claimed to the Azamara Onward

- If you’re also unsure in the one part of your tenancy arrangement otherwise require so you can demand consent to have summer arrangements, speak to your landlord otherwise agent.

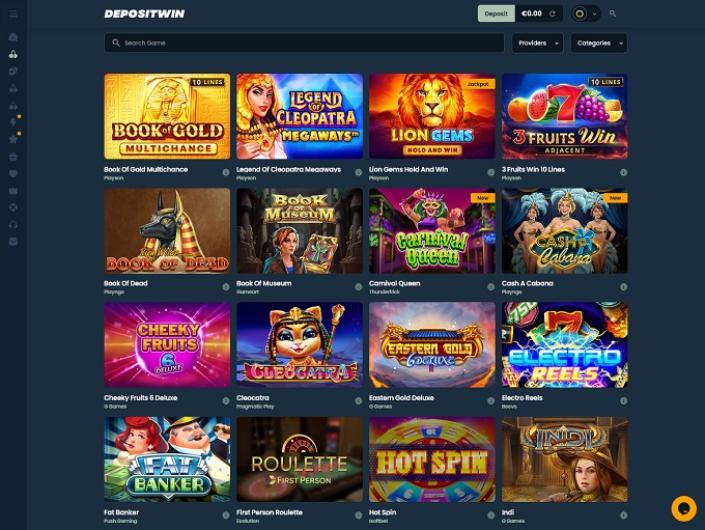

- Come across less than to find the best no deposit bonuses and ways to claim them.

- Find out more about the way we select the right financial products and our methodology to have looking at financial institutions.

- Created by a small grouping of internet casino benefits, Minimal Deposit Gambling enterprises is designed to come across you the best bonuses and you can offers from best casinos in the business give you the finest affordability.

- Function W-cuatro has five steps that will give guidance to the employer to work the withholding.

For those who have an enthusiastic Oregon EBT credit, you can check what you owe by going to . You can also name the number on the rear of your own Oregon EBT card or check your history store acknowledgment to have a benefit equilibrium. For new applicants inside the 2025, professionals have a tendency to superstart immediately after the job is actually reviewed and you may approved. We’ll give you an alerts by post concerning your kid’s qualifications within 15 days of the application being processed. In case your kid are immediately qualified, might found a page immediately after benefits is granted, confirming their qualifications.

- Speak to your regional taxation service for information about income tax withholding.

- Cash info were resources paid back by the dollars, take a look at, debit credit, and you may charge card.

- When you start another work, your employer will be make you a questionnaire W-4 in order to fill out.

- Really local casino incentives – as well as no-deposit also offers – come with a couple of regulations and you can constraints.

How much does the fresh Fed price announcement indicate for family savings bonuses?

Essentially, taxation statements and you will come back advice are private, as required by the point 6103. However, point 6103 lets otherwise requires the Internal revenue service to reveal otherwise give all the information shown in your tax go back to anybody else since the discussed on the Code. We could possibly in addition to disclose this informative article to other countries under a taxation treaty, so you can state and federal businesses so you can enforce federal nontax criminal legislation, or perhaps to federal the authorities and you will intelligence organizations to fight terrorism.

Before you make one financial choices, along with those individuals associated with repaired dumps, delight talk to a qualified economic elite and refer to the brand new newest direction awarded because of the Monetary Authority of Singapore (MAS). The fresh views expressed here are only our own and do not represent the fresh opinions of any regulated visit this website lender. We deal with zero accountability for your losses otherwise destroy incurred since the a direct result the application of this information. These types of fixed put schemes might require new finance to qualify for the brand new said rates. These types of promotions give you the complete best interest rate for those who wear’t have the need accessibility the financing to your given terms.

Finest highest-give offers accounts of July 2025 (To 4.44%)

Your next stimulus consider qualifying income is based on your 2019 taxation go back just in case you document a profit. SSI and you can veterans will get so it percentage in the sense they got its very first stimulus take a look at. I simplified the ranking by only offered the individuals discounts account that provide an over-average rate of interest, no month-to-month maintenance fees and you will lowest (if any) minimal balance/put criteria.

Bet $ten, score $150 inside bonus bets for those who win (MI, Nj, PA, WV)

Your employer is’t choose when you should keep back taxation for the transfer of either real property or individual property of a type generally held to own funding (for example stock). Your boss must withhold income tax throughout these professionals at the time of your transfer. Your employer considers the worth of benefits paid off out of November 1, 2023, due to October 30, 2024, while the paid back for your requirements within the 2024. To search for the overall worth of benefits paid back for your requirements inside the 2025, your boss can add the worth of any pros paid-in November and you will December out of 2024 on the property value any professionals paid in January because of Oct out of 2025. Such punishment have a tendency to apply if you deliberately and knowingly falsify your own Mode W-cuatro so that you can remove or take away the proper withholding from taxes. An easy mistake otherwise a respectable mistake acquired’t cause one of these punishment.

After earnings and information surpass the new $two hundred,100 withholding threshold, were the info your workers claimed inside quarter, even although you were not able to help you keep back the brand new staff tax from 0.9%. Employers inside the Western Samoa, Guam, the brand new CNMI, the brand new USVI, and you may Puerto Rico can also be ignore lines dos and you may step 3, if you do not have team that subject to You.S. taxation withholding. Charges and you may interest are recharged to your taxation paid off later and you can production recorded later at a consistent level place by law. Go to Internal revenue service.gov/EmploymentEfile more resources for digital filing. For many who file a magazine get back, the place you document utilizes whether or not you are a cost with Mode 941.

Contact the newest payer if it isn’t obvious that payer provides approved the Setting W-4V. Betting profits away from bingo, keno, and you can slots are certainly not susceptible to taxation withholding. Although not, you may need to supply the payer which have an SSN to help you stop withholding.